Select Board Perspectives: Have Marblehead’s Resources Been Well Managed?

In the months leading up to next Tuesday’s election, Marblehead residents and candidates from all contested races have had financial management on their minds. From the many millions of dollars raised from multiple past tax overrides and now largely gone, to the fact that no transfer station building was ever built, the Board of Health candidates have had to contend with how to move forward with the money that remains available. School Committee candidates have been focused on the current override proposal that is on next week’s ballot as Question One. And candidates in other contested races like Rec & Park and the Light Department have their share of resources-related questions to consider, with, respectively, questions surrounding a $2 million bequest for winter recreational activities and finding the appropriate balance between electric rates and clean energy goals.

The Select Board candidates arguably face some of the most challenging financial questions — looking both forward and backward — in determining where mistakes might have been made, whether transparency has been lacking, and more. Some candidates have made it clear that they do not believe there has been anything awry in the recent past with respect to the town’s money management, while others have taken the opportunity to highlight examples of perceived conflicts of interest and obfuscation.

Earlier this year Marblehead Beacon ran a multi-part series about millions of dollars of taxpayer funds being held at suboptimal interest rates at National Grand Bank — where Select Board member Jim Nye serves as the bank’s president. Some of the questions raised in our series from several months ago remain unanswered, with several Select Board candidates also declining to respond to our inquiries about their perspectives on topics relevant to the upcoming election.

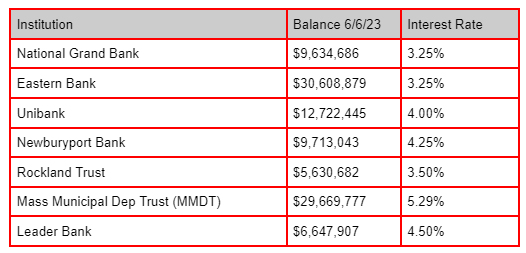

Marblehead Beacon has continued following up to see if changes are happening to make the most of town funds. The most recent data we have is provided in the chart below.

*Not included in chart above: Bartholomew and Company, with $9,021,070 in holdings at 2.33% as of April 30, 2023, the most recent statement date available.

Additionally, one of the issues we raised in our investigation regarding prudent financial management of town funds involved “positive pay,” which is “an automated cash-management service used by financial institutions employed to deter check fraud.” National Grand Bank — where town employees’ payroll has been transacted for many years — does not offer the increasingly common positive pay protection. Following Marblehead Beacon’s questions, we were informed by Marblehead Treasurer Rachel Blaisdell that as of June 1, 2023, town payroll would be moved to Eastern Bank. We have not yet received confirmation about whether that change was implemented.

As part of our election coverage, we asked every Select Board candidate a series of questions, with previous topics addressing governance procedures, the appointment process, and the likelihood of a successful override this year or next. The fourth and final question for the Select Board candidates involves their reflections on past financial management decisions. The candidates’ replies are listed in alphabetical order below, similar to our prior three articles about this race, but this time starting with the fourth candidate in the rotation.

Are you satisfied with the way that Marblehead’s resources have been managed over the past several years? Now that Marblehead appears to be in the process of moving its payroll to a new bank that offers the Positive Pay fraud detection service and other features, do you believe that there are issues of concern with regard to the ways in which the town’s funds have been invested previously? What do you think precipitated the banking changes that are now being implemented and do you believe other changes are warranted?

Erin Noonan

“I appreciate the Beacon’s investigative journalism on this topic and the discussion it sparked at a recent Select Board meeting. As noted at the meeting, we’ve had a number of vacancies in the Finance Department since last Spring. I look forward to our new Finance Director, Aleesha Benjamin, and Treasurer, Rachel Blaisdell, showing leadership on these issues and stewardship of the town’s assets. And as a member of the Select Board, I will continue an oversight role.”

Jim Nye

Did not respond to Marblehead Beacon’s request to participate in our questionnaire.

Alexa Singer

“There are many positive changes to highlight within the past year. We contracted with ePlus for our IT needs and security. The computers were upgraded and migrated to 365. ClearGov, a financial software program, was adopted and will allow for more efficient, effective, and transparent financial reporting. We presented a multiyear pavement management plan last year and followed it with comprehensive sidewalk, lights, and tree plan this year. These two plans will be connected to ensure we are maximizing taxpayer dollars. We completed several multiyear projects to ensure we are ready to apply for grants and any other funding opportunities.

We have filled the vacancies in the finance office and now have a new experienced finance director in place. The town treasurer and their team are actively working on the accounts. We have addressed the staff turnover and have a team in place to manage and maximize the investment accounts. The Select Board is responsible for promoting a team approach to managing the fiscal health of Marblehead.”

Jackie Belf-Becker

“These questions have been asked and answered. With the hiring of a new Tresaurer last Fall, and the new Finance Director this Spring, I have complete faith that the town funds are being handled correctly.”

Moses Grader

Did not respond to Marblehead Beacon's request to participate in our questionnaire.

Bret Murray

“Despite not having a Finance Director and/or Treasurer for several months, measures should have been taken to ensure our Finance Department was being properly managed. CliftonLarsonAllen LLP (“CLA”) was hired by the town to conduct a Finance Department assessment and issued its report on December 7, 2021. The CLA report contained 23 findings and recommendations, 10 of which were rated high priority. Had the town taken steps to address these recommendations sooner, not only would we be further along in meeting industry best practices, but we also might have mitigated some of the financial risk exposures we now know about.”