Marblehead Forfeits $300,000+ in Interest on Cash at NGB Alone

By Lena Robinson and Jenn Schaeffner

In late January Marblehead Beacon reported that National Grand Bank (NGB) – where Select Board member Jim Nye serves as president – was paying interest in the range of a quarter of one percent to one percent on millions of dollars of Marblehead municipal money, while significantly higher rates were readily available at other banks offering the same functionality and resources. Our follow-up article outlined the lack of transparency and failure of public officials to respond to our questions and public records requests pertaining to the Town’s cash management.

In response to our appeal to the Massachusetts Secretary of State, the Town was ordered to fulfill Marblehead Beacon’s public records requests by last Friday, February 24, 2023, and Marblehead’s recently hired treasurer, Rachel Blaisdell, has been extremely responsive.

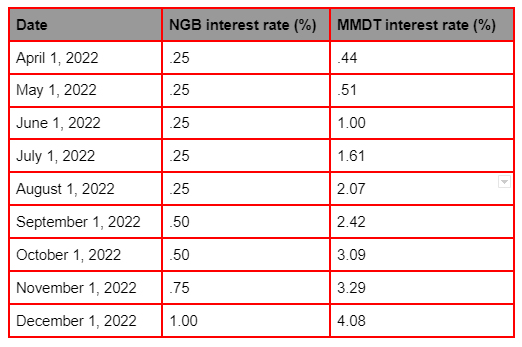

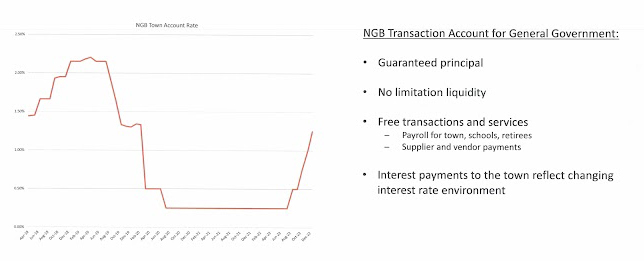

The information recently provided to Marblehead Beacon indicates that the amount held at NGB over the course of 2022 varied month to month, from a low of $15 million in July to a high of $33 million in November. Overall, the 2022 average daily balance held at NGB was $23 million. The interest rate paid on these funds remained at 0.25 percent through August 2022 and rose slightly over the next few months, finishing the year at a rate of one percent.

Significantly higher rates were available at other institutions during this same time period. For example, the state-chartered Massachusetts Municipal Depository Trust (MMDT) is used by the vast majority of municipalities in the Commonwealth. It currently holds public portfolios valued at approximately $30 billion and offers full liquidity for day-to-day cash management. Had Marblehead’s funds been placed at MMDT rather than NGB, the interest paid during 2022 would have been more than $300,000 over what was actually received.

Significant Interest Rate Increases, Except at NGB

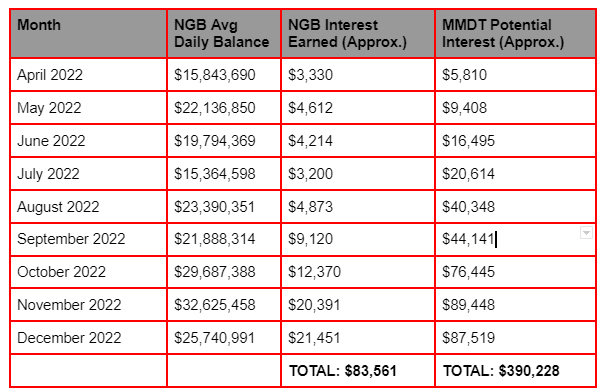

Interest rates were largely stagnant for a number of years, but they began to climb rapidly in April of 2022. The chart below shows the monthly interest rate paid by NGB versus MMDT over the last nine months of the year.

The approximate dollar value earned at NGB compared to what could have been earned at MMDT is shown below, adding up to a loss to Marblehead’s taxpayers of more than $300,000 in forgone interest payments over the course of 2022.

The losses continued during the first month of 2023, when Marblehead’s balance at NGB was approximately $19.5 million, which earned $20,000 interest, and would have earned $74,000 at MMDT.

Where is Marblehead’s Money Now?

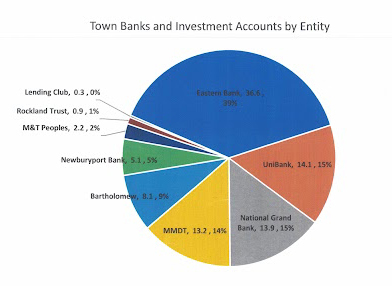

As Marblehead Beacon reported on February 8, 2023, Town Administrator Thatcher Kezer presented a grim view of the Town’s finances in his State of the Town report, projecting a need for significant budget cuts or new taxes in the form of a Prop 2 ½ override vote this year. He also addressed questions regarding the Town’s cash management, providing a pie chart, shown below, with an overview of Marblehead’s holdings. As noted in our previous reporting, the pie chart did not specify dates or interest rates. And, while the pie chart indicated a total of $13.9 million held at NGB, we now know that the actual average daily balance at NGB for 2022 was $23 million, with $15.1 million being held at NGB as of February 24, 2023.

Town of Marblehead Slide Presented at State of the Town:

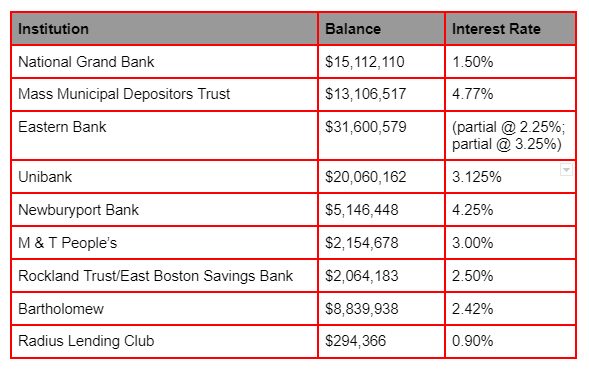

As a result of our public records request, Marblehead Beacon was recently provided a more detailed report of actual holdings as of February 24, 2023 as well as relevant interest rates, as shown in the table below.

The amounts shown include both regular Town operating monies and trust funds, which are accounts designated for a specific purpose usually as a result of a philanthropic donation, grant, or collection of fees. For example, funds held by the town at MMDT include a Water Department Fund, a Harbor Enterprise Fund, and a Massachusetts Water Resources Authority Local Water Assistance Fund. These types of funds are generally reserved for a specific purpose and are not included in the regular Town operating budget. It is unclear at this time exactly which accounts represent trust funds versus regular operating accounts holding tax dollars or money provided to Marblehead as part of the American Rescue Plan Act (ARPA).

Why is Marblehead Sticking With NGB Despite Losses?

Following the State of the Town presentation, Marblehead Beacon was able to schedule a meeting with Administrator Kezer and Select Board Chair Moses Grader to discuss our questions about the Town’s cash management and current holdings, specifically why such a significant portion of Marblehead’s assets were being held at suboptimal interest rates.

Kezer and Grader indicated that there were a number of reasons the Town preferred to stick with NGB, including the fact that these are transactional rather than long-term investment accounts and NGB offers what they call a “high-touch” experience, provides a “guarantee of principal” not offered by other banks, and offers fee-free payroll services. These claims were made both verbally and in a slide about NGB presented during the State of the Town (see below). Based on multiple conversations and in-depth research, it appears that these claims are not entirely accurate.

Town of Marblehead Slide Presented at State of the Town:

Many Transactional Accounts Pay More than NGB

Kezer explained to Marblehead Beacon that the funds held at NGB were needed for the short term, stating that the “money’s heading out the door sometime soon, so that makes sense that it stays in the transaction account rather than moving over to the investment account…known to be longer term.” Grader reiterated that “MMDT is not a transactional account.”

However, the rate comparison conducted by Marblehead Beacon was based on MMDT’s cash portfolio, not its long-term investment products. And its cash portfolio accounts, according to MMDT, operate as transactional accounts used by its customers to pay bills and make frequent transfers. Furthermore, other institutions – including standard banks that can be found through simple online searches – provide “transactional” accounts with interest rates far superior to those of NGB.

Grader also claimed about MMDT that “if you look at the yield, they really bump down below zero in the early part of 2022.” This also proved to be inaccurate, as was demonstrated through an examination of MMDT’s 2022 daily yield. On February 21, 2023, Marblehead Beacon spoke with Edward Costello, Vice President at Federated Hermes (the investment arm of MMDT), and he confirmed that MMDT’s yield has never gone below zero.

Is “High-Touch” an Appropriate Investment Rationale?

Kezer also justified the use of NGB by lauding its “high-touch” experience, which refers to personalized customer service. “We do a lot of transactions through them,” Kezer said, “so having that close relationship, when there are issues, it’s a good working relationship and they’ll give us the attention we need.” The Town of Marblehead’s Investment Policy, recently provided to Marblehead Beacon, specifies that Town funds are to be invested on the basis of safety, liquidity, and yield. There is no mention in this document of the need for a “high-touch” experience.

Marblehead Beacon was originally advised by Kezer that the only guidance for cash management decisions was Chapter 11 of the Massachusetts Treasurer’s Association manual, but Blaisdell recently located the above-referenced Marblehead Investment Policy in a drawer, and Kezer believes this document may have been in effect since 2014, though there remains some confusion between him and Grader as to whether or not it was ever approved by the Select Board.

Does NGB Offer a Guarantee of Principal?

The final rationale for holding tens of millions of dollars at NGB at suboptimal interest rates was that this bank offered a guarantee of principal. This claim was included on the slide about NGB presented at the State of the Town (see above) as well as directly by Grader during a conversation with Marblehead Beacon. When asked for specifics about a guarantee beyond standard FDIC insurance (through which the federal government insures every account in a unique ownership category up to $250,000), Grader replied, “I don’t know. That was actually just a word that I heard but I didn’t explore.” The conversation became heated, with Grader telling Marblehead Beacon that we should do our “bloody due diligence and ask one of the directors.”

Marblehead Beacon reached out to NGB for clarification about a guarantee on dollars held at the bank. Jim Nye, Select Board member and bank president, initially responded that this information was “private.” Upon receiving a follow-up request from us asserting that this information is not in fact private, he sent the following response on February 21, 2023:

“All deposit accounts at National Grand Bank are insured by FDIC insurance to $250,000. FDIC Insurance coverage may exceed $250,000 at one insured bank if the deposit accounts are in different ownership categories. More information can be found at https://edie.fdic.gov/fdic_info.html. Town accounts are covered by a pledge agreement between National Grand Bank and the Town of Marblehead. That agreement can be obtained from the Town of Marblehead.”

Marblehead Beacon requested a copy of the pledge agreement from the Town on that day. It has been a week, and thus far we have not received a response. In general, pledge agreements do not necessarily guarantee principal, but in the event that a bank were to fail, any account holder who is a party to a pledge agreement may have more recourse to recoup their assets (should any value in the bank remain).

Money held in interest-bearing accounts always comes with risks, even when such risks are low. MMDT does not have FDIC insurance protecting $250,000 dollars, but as is understood by the vast majority of Massachusetts municipalities and other public institutions that hold money with it, “MMDT was created to offer public entities an opportunity to combine their investment dollars in a pool that seeks safety of principal, liquidity, and competitive yield.”

Does NGB Offer the Town Fee-Free Payroll?

Though the State of the Town slide suggests that NGB does not charge the Town for managing payroll, Marblehead Beacon has learned from our conversation with Kezer and Grader that NGB does not, in fact, manage the Town payroll. It cuts salary and withholding checks for Town employees, but the process is actually managed entirely by Marblehead’s own payroll department.

A related issue is the failure of NGB to offer “positive pay,” which is “an automated cash-management service used by financial institutions employed to deter check fraud.” A report from Clifton Larson, commissioned by Marblehead in 2021, recommended that the Town implement positive pay “either at the current bank or utilizing another bank that will provide this service.” Marblehead continues to pay all Town employees from NGB, and it is our understanding that NGB still does not offer the positive pay service.

What’s Next for Town’s Cash Management?

Rachel Blaisdell, Marblehead’s new treasurer, informed Marblehead Beacon that she is “actively working on moving more funds and closing accounts.” At our meeting she stated that it was her intention that funds would be withdrawn from NGB by late February. She also indicated that while she is an independent decision maker on these matters who will not be pressured by other parties, she plans to consult the incoming Finance Director on some decisions. Aleesha Nunley-Benjamin is slated to begin her job today, March 1.

It is unclear at this time whether NGB will remain the holder of the Town’s primary operating accounts – particularly given what Blaisdell said about moving money out – or whether interest rates offered by NGB to the Town will increase to match those offered by other banks. There also remains a question as to what types of funds (general operating funds versus trust funds for specific uses) are being held in other institutions, for example: Unibank ($20 million at 3.125 percent interest) and Bartholomew ($8.8 million at 2.42 percent interest). Eastern Bank, which has various accounts totaling $31 million, and is paying 2.25 percent interest or 3.25 percent interest depending on the account, holds funds of various sorts, including Light Depreciation, General Fund, and Water Department monies.

With the exception of Newburyport Bank, which is paying 4.25 percent interest on Marblehead's holdings of $5 million, all banks holding Marblehead monies are paying significantly lower interest rates than MMDT, which is currently at 4.77 percent, though none of the other accounts with millions of dollars in assets has interest rates nearly as low as NGB.

As a final note, it appears that the Town of Marblehead is one of the largest depositors – if not the largest depositor – at NGB. Though the bank’s 2022 Annual Report is not yet available, the 2021 Annual Report stated that “[t]he Corporation has one customer with deposits amounting to $27,980,000, or 7.54% of total deposits, as of December 31, 2021.”

We know that the average daily balance at NGB for 2022 was $23 million, making it very likely that the Town of Marblehead is in fact NGB’s largest depositor. Documents posted on the NGB website indicate that the bank was doing well in 2021, with “strong earnings of $4.1 million from bank operations,” and stock valued at more than $8,000 a share and quarterly dividends, but faced a downhill trajectory during 2022, with “a loss of $(5,395,682) for the eleven months ending November 30, 2022.”

Marblehead Beacon spoke with Terri Tauro, Marblehead Municipal Employees Union President, about our investigation. She said, in part, "I am saddened by the lack of effort on behalf of the town administration to obtain as much interest as possible. Our employees are working short staffed and with sub-par equipment. That extra interest income could have gone a long way…to update our equipment/software or hire back lost positions.” Tauro also expressed confidence that new leadership would “work together” to “right the wrongs.”

Marblehead Beacon will continue to follow and report on issues with the Town’s cash management as they arise.