Latest Excuse for Poor Money Management Doesn’t Add Up

By Lena Robinson and Jenn Schaeffner

Over the past several months, Marblehead Beacon has published a series of investigative articles (seen here, here, and here) about the Town of Marblehead’s cash management, raising questions about hundreds of thousands of dollars in interest that have been forfeited due to funds being held in accounts offering sub-par interest rates.

Recently, another local news outlet – the Marblehead Current – published an article in which town officials, and in several cases the Current itself, offered up new justifications for the status of Marblehead’s fiscal management.

The article asserts as fact, for example, that “[t]he lack of a treasurer essentially made moving money impossible for months because state law vests the town treasurer with exclusive authority over where to deposit taxpayers’ money.” It also claims that the treasurer and finance director positions “remained vacant for months until the Select Board hired native Rachel Blaisdell in early December as town treasurer and Gloucester resident Aleesha Nunley-Benjamin as finance director in early February.” With respect to the collector/treasurer position, both of these claims are demonstrably false.

Incorrect Claims By Town Officials and Marblehead Current

First, the “lack of a treasurer” component has a faulty premise, in that even looking back a full two years, the Town has had a collector/treasurer or acting collector/treasurer at all times, as confirmed in part by some of the Current’s own past reporting. Prior to Blaisdell being hired in December 2022, two individuals served in the role. According to a Linked In profile of Michael Carritte, a story that ran in the Marblehead Reporter, another story that ran in the Current, and multiple Select Board minutes, Carritte was appointed as collector/treasurer on January 27, 2021 and remained in that role until his departure in September 2022. He also served as interim finance director for an unknown period beginning in May 2022. After Carritte’s departure, the Select Board approved Cami Iannarelli’s appointment as interim collector/treasurer, effective September 9, 2022 – a position in which she remained until Blaisdell was hired. So while a permanent treasurer was not in place from early September 2022 to the end of November 2022, at every point in our lookback there was always someone in the role, including during those few months.

The Current states that without a treasurer, “moving money” was “essentially” impossible, as it is only a treasurer who has “exclusive authority over where to deposit taxpayers’ money.” This, too, is incorrect. Assistant treasurers are provided for under Massachusetts law, which explicitly states that “[a]n assistant treasurer may perform all the duties of the treasurer.” Iannarelli has been (and remains) the Town of Marblehead’s assistant treasurer since November 2019, and as noted above, was appointed acting collector/treasurer from September 2022 until Blaisdell was appointed at the end of November 2022. Furthermore, if the Current’s assertion were true, any municipality could become paralyzed and possibly fail in its most basic fiduciary duties were it not able to conduct business when a treasurer is out on sick or maternity leave, or absent for any period of time. In our discussion last month with Iannarelli and Blaisdell, it was evident that Iannarelli is extremely busy performing tax collection and other critical financial duties. Serving in the acting collector/treasurer role from September to the end of November was undoubtedly an additional strain on her time, but it certainly did not equate to there being no one in the role.

Finally, based on our research, money was deposited and transactions were executed on numerous occasions during the time period in question – further calling into question the “moving money was impossible” narrative. Marblehead Beacon met with Kezer and Select Board Chair Moses Grader in February. They also both made public statements at the February 1, 2023 State of the Town meeting. While they emphasized the challenges of turnover in the finance department, they did not assert to us or at that televised meeting that “moving money [was] impossible” due to the absence of a treasurer or for any other reason, nor did any of the numerous Town officials to whom we reached out during our investigation make any such assertion.

A Firewall Between the Select Board and the Treasurer?

The Current article also noted that “[s]tate law creates a firewall between the Select Board and cash-management functions.” Nevertheless, in an apparent response to our investigation, we have seen a Select Board member publicly express enthusiasm for holding town funds at NGB. For example, Select Board Chair Grader told the Current that NGB “provides a level of service that the town has come to value over a long period of time.” And Grader along with Kezer waged a spirited defense of the Town’s cash management and its reliance on NGB at the State of the Town meeting. The Town Administrator and Select Board ultimately are responsible for appointing the Treasurer, so while Blaisdell advised the Current that Select Board members “‘don’t have the right to say anything about the management of accounts,’” and shared similar sentiments in a conversation with us, having one member of the Select Board serve as NGB’s president and another tout the bank’s merits could conceivably influence decision making.

Rehashing Question of Transactional vs. Investment Accounts

In addressing Marblehead Beacon’s questions about $300,000-plus in squandered interest payments, Town Administrator Kezer told the Current that the “‘math is correct, [b]ut the underlying argument is wrong.’” He also noted that comparing rates paid at NGB to rates at other institutions paying higher rates is like comparing “‘apples to oranges,’” because those other accounts are non-transactional.

Even a cursory investigation into available interest rates on checking accounts demonstrates that the rates offered by NGB did not and do not match those readily available elsewhere – much less those held in Massachusetts Municipal Depositors Trust’s (MMDT) cash portfolio. (Marblehead Beacon elaborated on this matter at great length in our prior articles.) Furthermore, even if it were true that all available transactional accounts pay a similarly low interest rate to NGB, the question remains as to whether it is ever prudent to hold large sums of money in such an account rather than accruing material interest at, for instance, MMDT, and only transfer as necessary the amounts required to cover payroll and other costs. As we addressed in our earlier articles, MMDT’s cash portfolio funds are liquid (and available for immediate transfer at all times).

Where is Marblehead’s Money Now?

In a February 2023 meeting, Blaisdell acknowledged the low interest rates being earned on Marblehead funds and informed Marblehead Beacon that she planned to transfer at least the funds held at NGB by the end of the month. According to the Current article from just last week, “Blaisdell said the town of Marblehead has had accounts with the National Grand Bank since the 19th century. Its accounts are among the Pleasant Street bank’s oldest,” which might suggest that large sums could remain at NGB, regardless of how their rates compare to the marketplace.

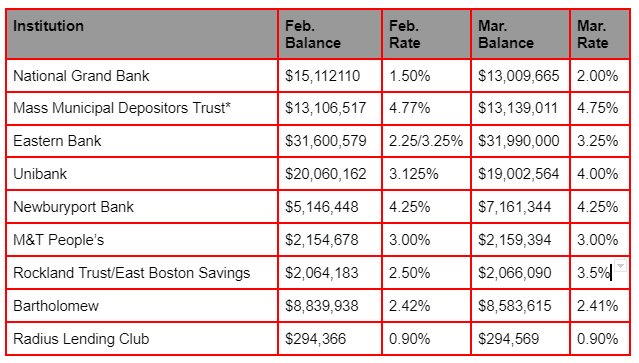

As of March 15, it appears that a substantial portion of Marblehead’s assets remain at NGB, with overall asset distribution generally unchanged since Marblehead Beacon began its reporting. Our previous article included a chart showing fund distribution and interest rates in February 2023. For comparison, the chart below compares that February data with the data we just received from Town this week, along with current interest rates.

*Blaisdell informed Marblehead Beacon that the amount listed for MMDT includes the General Fund only, and that $23.4 million is held at MMDT if trust and other accounts are included.

National Grand Bank Pledge Agreement

As previously reported, Select Board member and NGB President Jim Nye responded to our inquiry about the existence of a pledge agreement between NGB and the Town of Marblehead, advising us that we would need to contact the Town to receive a copy. We did so, but did not receive a reply to our public records request within the allotted ten days. On March 12, 2023 we filed another appeal with the Secretary of State’s office, and we finally received the pledge agreement from the Town’s keeper of records on March 14.

The document is dated September 9, 2022 and is signed by NGB’s Vice President and Chief Financial Officer. It is not notarized nor does it include a date stamp indicating date of receipt in the Town offices. It also is unclear if the deposits held at NGB prior to this date were unsecured, or if this pledge agreement is a successor agreement. (Note: Marblehead Beacon began asking questions in August 2022 about interest rates and where some of the Town’s monies were being held.)

In essence the pledge agreement appears to provide collateral to the Town of Marblehead on its deposits in the form of 10,000 shares of common stock in Pleasant Street Investment Corporation (PSIC) – a corporation that is 100 percent owned by NGB, according to a 2020 Federal Reserve filing. The Town of Marblehead would in theory be able to liquidate the stock were NGB to default on paying the Town its deposits, though a situation involving a default could also render those shares valueless. The pledge agreement further requires NGB to maintain assets with a market value of no less than $30 million at all times and to provide monthly updates to the Town regarding those assets, which are held at State Street Bank and Trust Company. Marblehead Beacon is requesting documentation and conducting further investigation into the pledge agreement’s origination.

What’s Next?

Town Administrator Kezer advised the Current that questions about interest rates are “distracting me from addressing the structural deficit and building a budget that sets Marblehead up for success.’” We have no desire to serve as a distraction. But in a financial climate that includes talk of deficits, tax increases, and austerity measures, Marblehead Beacon remains committed to reporting our findings to stakeholders, and to serving as a source of comprehensive and well-researched information that is not available elsewhere.