Follow the Money: Town Still Forfeiting Interest on Tens of Millions of Dollars

Earlier this year, Marblehead Beacon published a three-part series – available here, here, and here – about how the town was managing its funds, as well as a follow-up article addressing the town’s responses to our findings.

As we reported, our investigation discovered that tens of millions of dollars were being held in accounts earning subpar interest rates, potentially forfeiting hundreds of thousands of dollars in interest payments on taxpayer money.

Over the summer, Marblehead Beacon once again issued our regular request for an update on the town’s financial holdings. This time – as we reported last month – part of our request was denied. We subsequently appealed to the Massachusetts Secretary of the Commonwealth and received a ruling in our favor, requiring the town to provide the requested information, including bank names, totals held, applicable interest rates, and types of accounts at each bank.

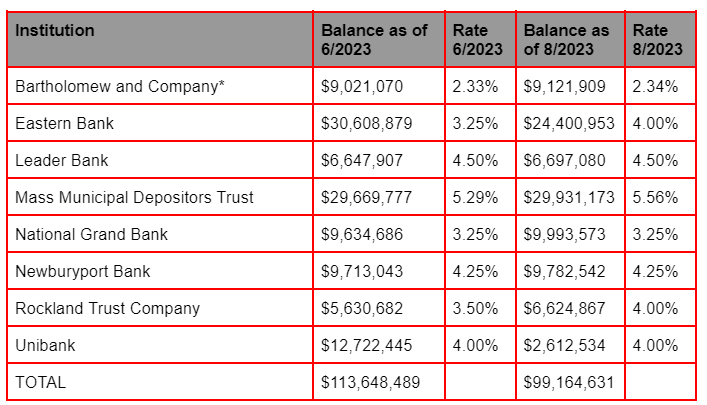

The chart below provides the most recent information showing account totals from August, alongside the comparable data from two months earlier.

*The balances and rates from Bartholomew and Company are from April and July 2023 rather than June and August 2023, respectively.

Fraud attempts at National Grand Bank

The role of National Grand Bank (NGB) in holding Marblehead town funds was a primary focus of our previous reporting. At that time NGB was being used to handle the town’s payroll services and accounts payable. As such, it was regularly the repository for tens of millions of dollars of taxpayer funds, yet it was paying significantly lower interest rates than those offered at the time by other banking institutions with similar liquidity and safety profiles. Longtime Select Board member Jim Nye was then and remains the president of NGB, raising issues of potential conflict of interest given the Select Board’s role in hiring the employees who oversee the town’s financial interests.

Also of note was the fact that NGB lacked a common check-fraud detection feature known as positive pay. The associated risks had already been highlighted in a publicly available review of the town’s finance department – published in December 2021 – by consulting firm CliftonLarsonAllen. “We recommend implementing positive pay,” the report noted, “either at the current bank or utilizing another bank that will provide this service.”

Aleesha Nunley Benjamin, Marblehead’s finance director, maintains that – as a result of articles that “published and promoted” the lack of positive pay at NGB – Marblehead Beacon is responsible for two instances of fraudulent checks being presented for payment. “Once the article was published,” she wrote, “it prompted fraud, by alerting scammers that we did not have security in place to notify us of faulty checks being presented to the bank.” Asked about the current status of the fraudulent checks and whether or not they were successfully cashed, Benjamin declined comment because “this is an ongoing investigation by the Marblehead Police Department and the checks in question are evidence of a crime that is under investigation” but did assert that the perpetrators were not local. Marblehead Police Chief Dennis King advised Marblehead Beacon that the matter is still open, and the identity of the perpetrators is unknown.

Town Payroll Moved to Eastern Bank

In late spring of this year, following our series of articles, Marblehead Treasurer Rachel Blaisdell informed Marblehead Beacon that plans were in place to move the town payroll and accounts payable to Eastern Bank, which does offer positive pay. It appears from the recent financial report that the change has already been instituted or is in the process of taking place. The report provided by the town indicates that both NGB and Eastern Bank are being used for payroll services, though a note associated with the NGB line item indicates that the town “must keep the accounts open until 10/2023 so all checks can clear.” As of August 21, approximately $9 million was being held at NGB at a 3.25 percent interest rate. In addition to payroll, the bank is also said to be holding accounts for the general fund, a historical trust, the light enterprise department, and the water and sewer department. It is not immediately clear whether all of these accounts are being moved in October, or payroll and accounts payable only.

Interest forfeited with current investment strategy

As noted in the chart above, the interest rates being earned on Marblehead town funds are as high as 5.56 percent, which is being offered by the Massachusetts Municipal Depository Trust (MMDT), an investment fund created in 1975 by the General Court of the Commonwealth “to offer public entities an opportunity to combine their investment dollars in a pool that seeks safety of principal, liquidity, and competitive yield.” The funds not held at MMDT are placed in assorted banks offering interest rates ranging from 3.25 percent to 4.5 percent.

In addition, approximately $9 million is held at Bartholomew and Company – an investment advisory firm with a reported interest rate of 2.34 percent. Marblehead Beacon reached out to Benjamin to ask about this relatively low interest rate. “The low 2.34% is due to the current market,” she replied, “and will rise based on investment performance, based on economic conditions for Trust Funds.” Benjamin also emphasized that “our primary goal is to achieve a fair market average [rate of return,] not the highest yield” (emphasis in original).

Marblehead Beacon asked last week for further clarification on what Benjamin would define as a fair market average interest rate given current conditions. We had not yet received a reply as of publication time.

By way of context, the current rate of return on a 30-day U.S. Treasury bill is 5.28 percent, guaranteed by the “full faith and credit of the U.S. government.” In addition, a recent CNBC article recommending money market accounts listed eight banks offering annual percentage yields (APY) in excess of five percent.

In her response to our original inquiry, Benjamin asserted that she was – pursuant to the town’s financial policies – prioritizing safety and liquidity, with yield the third most important priority. She further noted that the variety of accounts holding Marblehead town funds “are being used for diversification purposes, in compliance with Massachusetts General Law, and for liquidity. The Town invests in multiple banks and local banks to have quick access also known as liquid access to our cash as needed.” Marblehead’s Financial Policy document notes that “state law further requires that invested funds are to be placed at the highest possible rate of interest reasonably available, taking account of safety, liquidity and yield.”

While MMDT is offering 5.56 percent interest and 30-day US treasuries are paying 5.28 percent, the highest rate of return being earned on Marblehead town funds outside of MMDT is 4.50 percent from Leader Bank (a bank that offers positive pay), which holds approximately $6.6 million. By way of comparison, if the $9 million currently earning 2.34 percent at Bartholomew was instead earning 4.50 percent, it would yield an additional $194,400 in interest over the course of a year. At 5.28 percent, there would be $264,600 in additional interest.

For every $10 million in assets, forfeiting one percent of interest costs $100,000 annually, two percent costs $200,000, and so on.

All told, the Marblehead funds being held at all banks other than MMDT – totaling approximately $69 million in assets – would earn an additional $860,000 annually ($72,000 per month) if invested in accounts paying a five percent yield rather than their current returns and an additional $1.25 million annually ($104,000 per month) if invested at the 5.56 percent rate offered by MMDT. This appears to be achievable while simultaneously ensuring that diversification, safety, and liquidity are prioritized above the yield.

Editor's Note: The original version of this story mistakenly listed the total Marblehead holdings as of June 2023 as $104,627,419 rather than $113,648,489.